A domestic economic slowdown, two years of Covid-19 pandemic, and a war in Europe that upended the global supply chain tested the past four Union Budgets that Finance Minister Nirmala Sitharaman presented. Her fifth Budget, set to be presented on Wednesday, would now have to take into account equally challenging headwinds.

Even as India is a relatively bright spot in the global economy, most of its big trading partners in the West, and China are bracing for a deep slowdown and, in some cases, a recession.

The challenge for the finance minister is now to ensure that India remains on a path of growth of around 6 per cent, the Centre keeps its focus on high-multiplier public investment, that tax revenues stay robust, and the fiscal consolidation roadmap is adhered to, despite the burden of subsidy and welfare scheme spending.

“Short-term remedies should not stand in the way of long-term growth. The headwinds are severe. Most people know that because of geopolitical energy and economic shocks, the world economy is going to slow down. In this context, the issue for us is how much focus should be on growth, and how much should be on inflation,” Ashok Lahiri, former chief economic advisor and member of the 15th Finance Commission, told Business Standard.

“The minister has to go for a judicious mix of tax reforms, expenditure reprioritisation, and fiscal consolidation,” said Lahiri, who is currently a member of the West Bengal Legislative Assembly.

The International Monetary Fund expects a third of the global economy to slip into a recession this calendar year. The World Bank, in its January 2023 Global Economic Prospects Report, has said that global growth is projected to decelerate sharply this year, to its third slowest pace in nearly three decades.

“This reflects synchronous policy tightening aimed at containing very high inflation, worsening financial conditions, and continued disruptions from the Russian invasion of Ukraine. Global growth is expected to decelerate sharply to 1.7 per cent in 2023, against 3 per cent expected just six months ago,” the World Bank said.

As reported earlier, the 2023-24 Union Budget is likely to target a fiscal deficit of between 5.5 per cent and 6 per cent of nominal GDP, and the 2022-23 Economic Survey — to be tabled on Tuesday — is likely to forecast a real GDP growth of 6-6.5 per cent for the coming fiscal year.

“The FY24 Budget presents a challenge before the government to stick to the road map for fiscal consolidation, amid a global environment of declining inflation. For India, this could make things difficult to set a nominal GDP number significantly higher than 10 per cent, with a deflator of around 3.5 per cent. But this could also mean a higher GDP growth than anticipated at around 6.2 per cent,” said Soumya Kanti Ghosh, chief economic advisor, State Bank of India.

Ghosh expects the Budget to target a deficit of close to 6 per cent.

Revenue

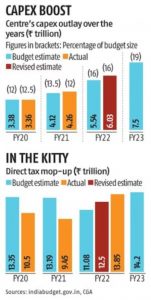

On the revenue front, the Union government is likely to keep its ambition of growth in direct taxes moderate for FY24, following buoyant tax receipts in FY23. For this fiscal year, the government expects direct taxes to be revised upwards as the mop-up is likely to exceed the Budget Estimates by at least Rs 1-1.5 trillion.

According to sources, Budget Estimates (BE) for FY24 may peg 12-14 per cent growth in the direct tax collection for FY24 over Rs 14.2 trillion BE of FY23.

Policymakers may tweak the two-year-old alternative personal income tax regime to make it attractive. At present, taxpayers don’t pay income tax if their taxable income is Rs 2.5 lakh and below. Increasing this threshold will reduce the tax outgo for assessees, thereby leaving more money with them to invest.

Currently, only a tiny fraction of taxpayers has opted for the alternative tax regime. For many, the tax outgo in the older personal income-tax regime is lower, if they make use of deductions, such as under Section 80C and Section 80D.

The Budget may also announce increasing Customs duty on at least 40 items including private jets, high-end electronics, and jewellery.

On divestment, the government has achieved almost half the disinvestment target of Rs 65,000 crore for the current fiscal year. FY23 disinvestment receipts are unlikely to be anywhere close to the budget target. The government may set the FY24 disinvestment target below Rs 60,000 crore, according to sources.

The disinvestment department is hopeful of having a lower disinvestment target for FY24 or being allowed to consider dividends as part of disinvestment receipts.

The focus would be on completing pending transactions like stake sale in IDBI Bank, and privatisation of Concor, Shipping Corp, BEML, and the Nagarnar plant of NMDC, among others.

Expenditure

“We expect the government to boost rural spending and maintain double-digit growth in public capex in FY24. Even as we assume slower tax revenue growth on moderation in nominal GDP growth, a lower subsidy burden (largely led by food and fertiliser) will help create fiscal space to reallocate money towards existing rural schemes, including rural employment, rural housing, and roads,” said Tanvee Gupta Jain, India economist for UBS.

On the expenditure front, there will be an expansion in capital expenditure, and the budgeted outlay may be above Rs 9 trillion against Rs 7.5 trillion in FY23. However, the capex expansion may not be as big as the two preceding years as the Centre believes private sector investment is improving.

With the new free foodgrain scheme under the National Food Security Act, 2013, sources said that the Centre would try to limit food subsidy bill to Rs 2 trillion in FY24. This would be much lower than FY23’s outlay, which has already crossed Rs 3.3 trillion.

The past few Budgets were about eliminating off-budget borrowing, something which Sitharaman and Finance Secretary T V Somanathan have succeeded in doing. The Budget for FY24 could be about controlling non-essential expenditures, through reducing leakages in subsidy and welfare schemes and better use of the Single Nodal Account Dashboard.

The Budget is also expected to increase the outlay for various production-linked incentive schemes, as they are seen as a cornerstone in the government’s efforts to create jobs and expand India’s manufacturing base.

Source: Business Standard, dated 30/01/23