Following the FY23 gross domestic product (GDP) advance estimates, economists have singled out the Indian economy’s relative resilience.

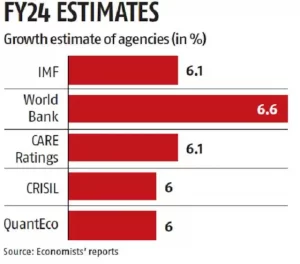

They, however, warn about a slowdown in the coming quarters due to a likely recession in developed economies, and see GDP growth in FY24 at around 6 per cent.

“India’s economic growth continues to remain resilient despite an uncertain global backdrop marked by slowing growth, elevated inflation, tight financial conditions, and lingering geopolitical tensions. However, downside risks to growth from global headwinds have risen materially in recent months,” said Shubhada Rao, founder, QuantEco Research.

The Indian economy may grow at 7 per cent in FY23, which is higher than projections made by the Reserve Bank of India (RBI) and the World Bank. This is according to the latest estimates by the National Statistical Office (NSO), which assumes a lower impact of the intensifying global headwinds.

In its latest World Economic Outlook, the International Monetary Fund (IMF) cut its growth forecast for calendar year 2023 global GDP and world trade by 20 basis points (bps) and 70 bps to 2.7 per cent and 2.5 per cent, respectively. It said that a third of the global economy will slip into recession.

“As global growth is set to witness a slowdown, manufacturing exports and sub-sectors that display high interest-rate sensitivity historically could remain on a weaker turf in FY23 and FY24. Taking these factors on board, we are pencilling in GDP growth of 6 per cent in FY24,” Rao said.

Rajni Sinha, chief economist with CARE Ratings, said that going ahead, tighter financial conditions and global recession fears could weigh on external demand and private investment.

The weak labour market recovery, high core inflation and fading of pent-up demand can be seen as the main downside risks to consumption.

“India’s growth outlook for FY24 remains clouded. Manufacturing sector could benefit from moderation in commodity prices but will feel the pain of lower external demand. The risk of resurgence of Covid cases globally could pose additional downside risk,” Sinha said.

On the domestic front, the expectation of easing inflation levels and good rabi output will be supportive of domestic demand, she said. She added that some moderation in growth numbers could be seen. This is due to cooling of pent-up demand and tighter financial conditions.

“Considering the headwinds arising on the external front and its possible spillover on the Indian economy, we expect the GDP growth to slow down to around 6.1 per cent in FY24,” Sinha said. DK Joshi, chief economist with CRISIL, said the slowdown is expected to intensify next year, as global growth falls further.

Ratings agency S&P Global is expecting the US to swing from a GDP growth of 1.8 per cent in 2022 to a contraction of 0.1 per cent in 2023.

It said the European Union will see lower growth from 3.3 per cent to 0 per cent. This will be driven by tight financial conditions induced by rate hikes by the Federal Reserve, and the European energy crisis.

“Over the past two decades, India’s growth cycles have become increasingly synchronised with that of advanced economies. This is due to enhanced integration of trade and capital flows. While domestic demand has stayed relatively resilient so far, it will be tested next year by weakening industrial activity,” Joshi said.

The Indian economy will feel the pressure from increasing transmission of interest rate hikes to consumers as well. It is also because the catch-up in contact-based services may fade.

“Due to these factors, we project real GDP growth to slow to 6 per cent next fiscal, with risks tilted to the downside. We expect the nominal GDP growth to slow from 15.4 per cent to around 11 per cent next fiscal,” Joshi said.

Source: Business Standard, dated 09/01/2023